In the hustle and bustle of modern life, where every journey fuels our daily adventures, the cost of getting from point A to point B can quickly add up. Whether you’re commuting to work, embarking on a road trip, or simply running errands, transportation expenses are an inevitable part of the equation. But what if your everyday travels could offer more than just the destination? Enter the world of cashback credit cards, where each mile driven and each tank filled brings you closer to rewards. In this article, we delve into the best cards designed to ease the burden of gas and transportation costs, transforming your routine expenditures into opportunities for savings. Join us as we explore the top contenders that promise to make your journeys not just necessary, but rewarding.

Maximize Your Commute Savings with Top Cashback Cards

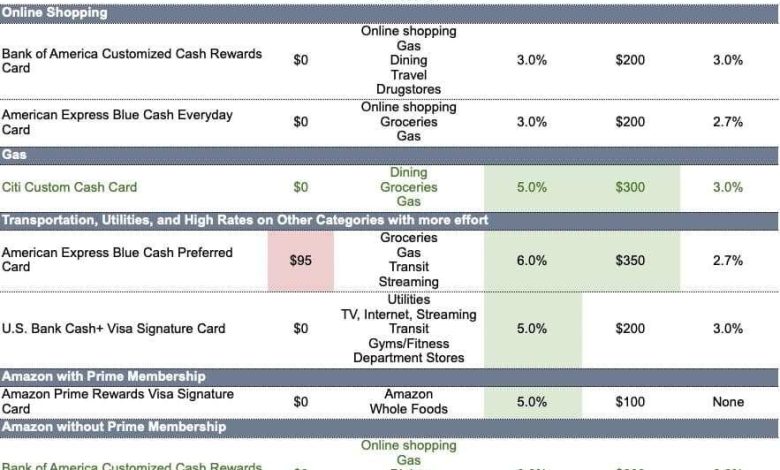

Discovering the right cashback card can significantly reduce your transportation expenses, making your daily commute more affordable. With a plethora of options available, selecting a card that aligns with your spending habits is crucial. Look for cards offering substantial cashback percentages on gas and transit purchases. Key features to consider include:

- High Cashback Rates: Seek cards that offer 3% or more on gas purchases and transportation services, such as rideshares or public transit.

- No Annual Fee: Opt for cards that waive annual fees, ensuring that your savings aren’t offset by additional costs.

- Flexible Redemption Options: Choose cards that allow you to redeem your cashback in various forms, whether as statement credits, direct deposits, or gift cards.

Embrace the opportunity to enhance your financial strategy by selecting a card that not only rewards your spending but also complements your lifestyle. By doing so, you’ll be able to turn your everyday commute into a rewarding journey.

Fuel Your Wallet: Cards Offering the Best Gas Rewards

Maximizing your savings at the pump doesn’t have to be a daunting task. With the right credit cards, you can transform every fill-up into a rewarding experience. Cashback on gas purchases is one of the most sought-after perks, and several cards stand out for their exceptional offers. Whether you’re a daily commuter or a weekend road tripper, there’s a card tailored for your needs.

- Rotating Category Cards: These cards offer generous cashback percentages on gas purchases during specific months of the year. By timing your fill-ups, you can make the most of these limited-time offers.

- Flat Rate Cashback Cards: If you prefer consistency, opt for a card that provides a steady cashback rate on all gas purchases year-round, ensuring predictable savings every time you refuel.

- Tiered Reward Cards: Designed for those who spend heavily on transportation, these cards offer increased rewards as your spending rises, allowing you to earn more as you drive more.

By strategically choosing the right card, you can effortlessly reduce your transportation costs while enjoying the open road. Look beyond the pump, as many of these cards also offer perks for other transit-related expenses, making them a versatile choice for any traveler.

Navigate Transportation Expenses with These Cashback Champions

In the bustling world of daily commutes and weekend getaways, transportation expenses can quickly pile up. Fortunately, some credit cards offer lucrative cashback rewards specifically tailored for gas and transit costs, helping you save as you go. Here’s a roundup of the best contenders to consider for your wallet:

- City Hopper Card: This card shines with its 5% cashback on all public transit expenses, making it perfect for urban dwellers and frequent travelers. Enjoy additional perks like no annual fee and exclusive discounts on rideshare services.

- Fuel Saver Plus: With a generous 3% cashback on gas station purchases, this card is a favorite among road warriors. It also offers 2% back on dining and groceries, turning everyday expenses into savings.

- Travel Rewards Elite: Designed for the jet-setter, this card provides 4% cashback on all travel-related purchases, including gas and tolls. Coupled with travel insurance benefits, it’s a top pick for those always on the move.

Each of these cards offers a unique blend of benefits tailored to your lifestyle, ensuring that every mile you cover brings you closer to valuable rewards. Choose the one that aligns best with your spending habits and watch your savings grow.

Expert Picks for Maximizing Cashback on Gas and Transit

In the quest for optimizing your cashback rewards on gas and transit, selecting the right credit card can be a game-changer. Industry experts recommend focusing on cards that offer high percentage returns on these specific categories. Here are some standout features to consider:

- Tiered Reward Systems: Look for cards that provide elevated cashback rates for gas and transit expenses, sometimes up to 5%.

- Rotating Bonus Categories: Some cards offer quarterly bonuses on gas or transit, which can be leveraged by planning your spending during these periods.

- Unlimited Cashback: Opt for cards that do not cap the amount of cashback you can earn, ensuring maximum benefit from every dollar spent.

By analyzing your spending habits and aligning them with the right card features, you can significantly increase your savings on everyday transportation costs. Strategic planning and smart card selection are your allies in maximizing these rewards.